- |

- Contact Us

- |

-

Sitemap

-

investor relations

- IR Home

- Corporate Information

- Financial Information

- Disclosures

- General Meeting of Shareholders

- General Meeting of Bondholders

- Debt and Bond Investor

- Stock Information

- Information Request

Are you looking for something?

Keyword suggestion

Report of the Board of Directors

Honorable Shareholders and Stakeholders,

First, let us send our praise and gratitude to God Almighty for granting His infinite blessing upon all of us. The year 2021 is a recovery momentum for PT Wijaya Karya (Persero) Tbk or WIKA or the Company, after previously to a certain extent being affected by the business dynamics in construction and infrastructure industry as well as the worldwide attack of the COVID-19 pandemic.

Therefore, the focus of this year was mainly on maintaining the resilience and sustainability of the Company’s business by paying attention to the health and welfare of employees, supporting government programs in accelerating national economic development through national infrastructure development.

Until the end of 2021, in the midst of ongoing Covid-19 pandemic, WIKA continues to make every effort to complete the projects that have been entrusted on time and in the best possible way. Until the end of 2021, WIKA has succeeded in completing several strategic projects that have been inaugurated directly by President Joko Widodo, including Kuningan Dam, Bendo Dam, Paselloreng Dam, Tugu Dam, and Serang-Panimbang Toll Road Section I. Also, this year, WIKA managed to obtain several strategic projects such as Cisumdawu Toll Road Section IV, Kediri Dhoho Airport, as well as several infrastructure and building projects.

Stil in this year, WIKA entered the airport investment sector through the establishment of an Implementing Business Entity (BUP) named PT Bandara Internasional Batam (BIB). BIB was formed by WIKA together with PT Angkasa Pura I (Persero) and Incheon International Airport Corporation (IIAC). These three are members of a consortium that won the auction of government and business entity cooperation project (PPP) at Hang Nadim Airport, Batam. WIKA holds 19% shares in BIB, Angkasa Pura I 51%, and IIAC 30%. The establishment of this BUP is expected to have a positive impact on the sustainability of WIKA’s business activities with the addition of the Company’s business portfolio in the airport sector.

Also in 2021, WIKA strengthened its business portfolio in the investment sector in the Drinking Water Supply System (SPAM), following the increase in share ownership in a subsidiary, PT Wika Tirta Jaya Jatiluhur (WTJJ) from 30% to 80%. WIKA hopes that this capital will improve the Company’s financial performance which in the end can create added value and provide dividends for Shareholders.

The Board of Directors, supported by the Board of Commissioners and all management of the Company, has a strong commitment to continue to do our utmost, work hard, and synergize in carrying out the mandate of managing the Company through a number of appropriate strategies, continuous innovation, and work programs to achieve the Company’s Vision, Mission and goals, while still meeting the expectations of Shareholders, employees, service users, and all other stakeholders.

Through this Annual Report, please allow us to submit a report on the management of the Company throughout 2021, as a form of our accountability to the Shareholders and all other stakeholders. This annual report is also an implementation of the Company’s transparency, which constantly strives to consistently and continuously uphold the Good Corporate Governance principles in carrying out daily business activities.

GLOBAL ECONOMY OVERVIEW

In the “Indonesian Economic Outlook” of the Coordinating Ministry for Economic Affairs, 2021 will be the year of economic recovery from the Corona Virus Disease (COVID-19) pandemic. Numerous countries continue to create appropriate strategies to encourage improvements from various aspects, including the economic aspect.

The International Monetary Fund (IMF) in its World Economic Outlook Update report, October 2021: Fault Lines Widen in the Global Recovery, projected global economic growth in the range of 5.9% for 2021. Meanwhile, the World Bank (World Bank) in its Global Economic report Prospect released in June 2021 projected that overall the world economy is predicted to grow 5.6% percent in 2021, the fastest post-recession pace in 80 years.

However, the global economic recovery is uneven, which is caused, among other things, by differences in the Covid-19 pandemic situation, speed of vaccination, and support for economic stimulus.

The trend of improvement in global economy is driven by the recovery encouraged by stronger economic recovery of the United States (US), as well as economic improvement in China and a number of countries in the European Region, which continues to take place in line with the acceleration of vaccination and continued policy stimulus.

A number of early indicators in the second quarter of 2021 confirmed the global economic recovery that continues to strengthen, as reflected in the Purchasing Managers’ Index (PMI), consumer confidence, and retail sales in several countries. The volume of trade and world commodity prices also increased. Crude oil prices, for example, reached their highest level for 22 months in mid-April 2021, ranging from 63-67 US dollars per barrel. The increase in oil prices is an indicator that demand is starting to increase and put the factory machines back in motion, in many parts of the world, including Indonesia.

Global financial market uncertainty began to lessen in line with the clarity of policy direction of the United States Central Bank (US) The Fed, which remained accommodative and considered that it was still too early to reduce the US monetary stimulus (tapering). These positive developments have again increased global capital flows to developing countries, including Indonesia, and encouraged the strengthening of currencies in these countries.

NATIONAL ECONOMY OVERVIEW

In the Q4 2021 Monetary Policy Review, Bank Indonesia reported that the improvement in national economy continues. This condition is reflected in a number of early indicators in the second quarter of 2021 that keep on improving. Household consumption indicators increased according to the seasonal pattern of National Religious Holidays (HBKN) such as retail sales, especially food, beverages and tobacco, as well as motor vehicle fuel. The improvement in domestic economy was also reflected in the performance of other indicators, namely consumer expectations, online sales, and Manufacturing PMI which continued to increase.

From external, the export performance continued to improve, particularly in coal, iron and steel commodities, as well as motor vehicles in line with rising demand for major trading partners.

Spatially, the increase in exports occurred in all regions, especially Java, Kalimantan, and Sulawesi-Maluku-Papua (Sulampua). The improvement in economy can also be seen in the continued improving performance of several key sectors, such as Manufacturing, Trade and Construction Industries.

Meanwhile, Indonesia’s Balance of Payments (BOP) is predicted to remain favorable, thus supporting the resilience of external sector. Rupiah exchange rate continued to strengthen in line with the re-entry of foreign capital inflows and Bank Indonesia’s stabilization measures. The Rupiah exchange rate on June 16, 2021 strengthened at 0.49% on average and 0.30% point-topoint compared to May 2021 level.

The inflation remains under control amid rising demand for HBKN seasonal patterns. Liquidity conditions remained loose, driven by accommodative monetary policy and the impact of synergy between Bank Indonesia and the Government in supporting the national economic recovery. The resilience of financial system is also maintained, although the banking intermediation function still needs to be encouraged. Bank Indonesia continues to strengthen payment system policies to accelerate digital economic and financial transactions and support national economic recovery.

Looking ahead, the domestic economic recovery will be driven by the acceleration of global economy, speed of vaccination, and strengthening of policy synergies, although still overshadowed by the increase in Covid-19 cases that occurred at the end of the second quarter. With these developments, the economic growth in 2021 will remain in line with Bank Indonesia’s projections for April 2021, which is in the range of 4.1%-5.1%.

INDUSTRY OVERVIEW AND WIKA’S POSITION IN THE INDUSTRY

For the construction and infrastructure industry, 2021 is a momentum for recovery. Data from the Coordinating Ministry for the Economy revealed that until the third quarter, the construction sector growth managed to return to a positive trend, where year-on-year growth in the construction sector which initially recorded a growth of -0.79% in the first quarter, began to increase by growing 4.42% and 3.84% in the second and third quarters.

The recovery of construction sector in 2021 was driven by several things, one of them is the increase in the realization of government capital expenditure for buildings by 42.20%. In addition, there has also been an increase in infrastructure development activities in line with the increase in imports of raw materials for construction activities.

Economic policies and other policies aimed at overcoming the domestic pandemic directly or indirectly also affected the course of construction and infrastructure businesses. The Emergency PPKM policy implemented by the Government has a huge impact on project development due to restrictions on community mobility and prohibitions on gathering to overcome the COVID-19 pandemic.

Nevertheless, we can still see an optimism in the construction industry in line with the Government’s focus on encouraging infrastructure development through the National MediumTerm Development Plan (RPJMN) 2020-2024 and the National Long-Term Development Plan (RPJPN) 2005-2025. This is also supported by the infrastructure budget in the 2021 State Budget amounted to Rp417.4 trillion, grew 48.4% compared to the previous year. The focus of the 2021 APBN budget allocation in the infrastructure sector is to strengthen digital infrastructure to encourage logistical efficiency and connectivity, development of public health facilities and provision of basic needs, laborintensive infrastructure for industrial and tourism areas, as well as completion of priority activities in 2020 which are still pending due to COVID-19 pandemic.

The Government’s development focus through the 2020-2024 RPJMN makes the construction industry still has great potential to continue to grow amidst challenges.

For this reason, PT Wijaya Karya (Persero) Tbk as an SOE Karya remains optimistic in completing ongoing projects by adjusting the Company’s Work Plan and Budget (RKAP). In addition to accelerating project completion, WIKA also seeks to acquire new strategic projects, both government and non-assigned, in order to be able to grow sustainably while giving contribution to Indonesia, not only during the pandemic but also in all situations given the tight construction industry in Indonesia.

Intense business competition makes WIKA constantly strive to maintain the quality of infrastructure project construction accompanied by a fast completion time. In addition, WIKA also continues to adapt in a sustainable manner by utilizing available resources owned to improve quality while providing added value for the projects being carried out as well as for the customers.

Until 2021, WIKA has been involved in a number of infrastructure development projects in Indonesia, including the National Strategic Project (PSN). Not only domestically, the Company also penetrates the international business by expanding its wings in the field of new renewable energy & energy conversion, including the birth of various innovative products based on renewable energy.

STRATEGIES, STRATEGIC POLICIES AND THE IMPLEMENTATION

The Company’s strategies and strategic policies are prepared with reference to the Company’s targets as stated in the 2021 Company Work Plan and Budget (RKAP). To respond to the existing challenges, especially the impact of the Covid-19 Pandemic, the Company revised its 2021 RKAP in August 2021.

The strategies and strategic policies in 2021 were focused on the Company’s efforts in anticipating every existing challenges to become growth opportunities. Some of the strategies carried out in 2021, among others, selective investment in quick win projects, developing digital innovation, developing employee competencies, and financial efficiency in both personnel and operational.

- The investment strategy applied is to make investments that have added value and a competitive advantage. The value added strategy is executed by making the right investment decisions and is expected to provide added value for the Company, especially in terms of the rate of return on investment. The competitive advantage strategy is an investment selection strategy to increase the Company’s synergy ability to provide added value to customers compared to competitors;

- The digital innovation development strategy is the development of innovations that can support the Company’s business growth;

- The efficiency strategy is executed by making continuous improvement efforts in every business process, both in terms of personnel and operational expenses;

- The competency development strategy is preparing superior, reliable, and professional human capital with excellent capabilities.

These strategies have been implemented effectively, supported by the commitment of Board of Directors and all employees of WIKA. Going forward, the Company will continue to make improvements in order to sustain its performance and encourage future business development.

BOARD OF DIRECTORS ROLE IN FORMULATING CORPORATE STRATEGIES AND STRATEGIC POLICIE

The process of formulating strategies and strategic policies to achieve the Company’s targets for the fiscal year is peformed on a bottom-up basis. Work units at WIKA are assigned to develop targets and strategies for achieving these targets, both for the next one year and for the long term.

The planned targets and target achievement strategies are then reported to the Board of Directors for joint review. Afterward, all operational and financial data are collected, from all subsidiaries, branch offices and projects worked on by WIKA, both domestically and abroad.

After that, a meeting is held to map out the existing challenges and opportunities, as well as to set out targets and future strategic directions, then harmonize them with the targets and strategies set out in WIKA’s Corporate Long Term Plan (RJPP).

After the targets are set, the Board of Directors determines future visions and missions that are relevant to the Company’s targets, strategies and business developments. The results of Board of Directors’ review are then presented at a meeting attended by all work units and subsidiaries, for further detailing the measures that must be implemented by each work unit and subsidiary to support WIKA’s strategy as a holding company.

BOARD OF DIRECTORS ROLE IN ENSURING THE EXECUTION OF STRATEGIES

The Board of Directors has a very strategic role in ensuring that the Company strategies are executed according to plan. Our duties as Board of Directors are supported by WIKA management system that has been digitized, so that we are able to monitor and acknowledge the development of the Company’s management in real time, starting from marketing, finance, taxation, human capital, and even project operations.

The digitization of this management system also facilitate us for early detection to identify any indications of irregularities in each work unit up to ongoing project.

COMPANY PERFORMANCE ANALYSIS

The year of 2021 is a recovery momentum when compared to 2020 where the construction industry, especially WIKA, is experiencing a slump. Almost all BUMN Karya experienced an increase in contract turnover compared to 2020. The momentum of this recovery is directly proportional to the movement or mobilization of people, where almost all transportation sectors, such as airports, train stations, and ports experienced a significant increase in passengers, thus making movement quite high.

WIKA also has a hotel holding business of 21 hotels. By the end of 2021, almost all of them are fully loaded. That is, the economy is starting to recover, the owners have also ventured to spend capex in infrastructure and property. This has had a positive impact on WIKA as a construction operator, both in terms of investment and construction.

However, the COVID-19 pandemic still has a significant impact, especially on financial and operational performance which in general did not succeed in exceeding the target set out in the 2021 revised RKAP.

The Company’s sales in 2021 were recorded at Rp17.81 trillion, an increase of 7.70% compared to sales in 2020 of Rp16.54 trillion. The increase in the level of Sales was contributed by the Infrastructure and Building Segment of Rp9.43 trillion in 2021 or an increase of 11.04% from 2020. Meanwhile, towards the RKAP target, the Sales level reached 75.01% of the target set forth in the RKAP of Rp23.74 trillion.

Net Profit decreased by 33.48% from Rp322.34 billion in 2020 to Rp214.43 billion in 2021. Meanwhile, against the RKAP target, Net Profit reached 51.47% of the target set out in the RKAP of Rp416.58 billion.

Total assets increased to Rp69.39 trillion from Rp68.11 trillion as of December 31, 2020. The increase in total assets reached Rp1.28 trillion or 1.87%. Meanwhile, the achievement of the RKAP target was 93.95%.

The Company’s total equity became Rp17.44 trillion from Rp16.66 trillion as of December 31, 2020. The increase in total equity reached Rp777.65 billion or 4.67%. Meanwhile, the achievement of the target was 94.05%.

In terms of operational performance, New Contracts recorded an increase of 14.70% from Rp23.37 trillion in 2020 to IDR 26.81 trillion in 2021. As for the RKAP, the achievement of New Contracts was 76.45% of the target set out in the RKAP of IDR 35 .06 trillion.

Meanwhile, Order Book in 2021 were recorded at Rp88.12 trillion, a decrease of 10.08% compared to 2020 which was recorded at Rp97.99 trillion. The contract value for the financial year reached 91.17% of the planned RKAP target of Rp96.66 trillion.

OBSTACLES, CHALLENGES, AND THE SOLUTION

The obstacle that is quite heavy and the most important is the impact of the COVID-19 Pandemic. The number of industries that have not yet grown, which are WIKA’s partners, have an impact on WIKA’s financial and operational performance.

For example, the automotive industry that experienced a decline in 2021, hence hampering the growth of our electric motorcyle products. Meanwhile, the most real challenge was the extremely low consumer interest in the property sector that continued in 2021, so that WIKA’s property products were not well absorbed.

The second challenge is that with restrictions on people movement to stop the spread of COVID-19, WIKA’s overseas projects also became a constraint.

In the future, the Company will continue to evaluate the implementation of preestablished strategies, so that the Company’s future performance can be improved continuously.

BUSINESS OUTLOOK ANALYSIS

The ongoing COVID-19 pandemic throughout the world, including Indonesia, is still the main concern of the Government, given its direct and indirect impacts on national economic growth and in industrial sector. However, gradual improvement in economic and industrial conditions in 2021 is expected to continue until 2022. In addition, the restrictions on people mobility such as PSBB and PPKM in Indonesia started to be loosen, hence expected to open up opportunities for people’s economic conditions to continue to improve although the new variant of COVID-19 still has to be watched out for.

The IMF through the World Economic Outlook estimated that global economic growth will be at 4.4% (yoy) in 2022. Even though there is a slowdown, the IMF’s forecast is an optimism that the world economy will continue to grow in line with the successful handling of the pandemic in 2021.

Based on the optimism on economic growth in 2022, we are also feeling optimistic that WIKA’s performance will continue to improve, even though the challenges that will be faced by the construction and infrastructure industry remain high. At least, we have identified 3 (three) opportunities for WIKA’s growth.

First, the national strategic projects that must be completed before 2024, hence by 2022 and 2023, we must speed up all national strategic projects, and WIKA’s sales or revenue will automatically grow.

Second, the international scale event that will be held in Labuan Bajo, East Nusa Tenggara (NTT) in 2023, namely the G-20 and the ASEAN Summit. This event requires a preparation in the infrastructure sector, which is certainly an opportunity for WIKA to obtain an assignment for new projects.

The third is the plan to relocate the Nation’s Capital City (IKN) from Jakarta to Penajam Paser Utara, East Kalimantan, and currently the related regulation has been signed. This plan will become an opportunity for WIKA to obtain assignments for government building construction projects.

In addition, the opening of a Special Economic Zone in North Kalimantan, which is quite large with a large budget, is also an opportunity for WIKA to continue to grow at least for 2022-2024. On these existing opportunities, we are optimistic that WIKA will grow positively into the future.

To support the Company’s growth, WIKA continuously optimizes its resources, including digital technology, ERP, and BIM, as well as increasing synergies both within the Company and with subsidiaries. The strategies and synergies carried out by the Company coupled with the optimism of entering the year of 2022 are believed to lead to the fulfillment of predetermined targets while at the same time supporting the realization of the 2020- 2024 RPJMN prepared by the Government in order to improve connectivity and provide basic needs for the Indonesian people.

Facing future conditions, the Company also utilizes appropriate, effective, and environmentally friendly technology so as to minimize the social impacts that may arise. In addition to increasing the Company’s growth, this is also done to make the benefits of infrastructure projects that WIKA worked on, can be felt by future generations.

DEVELOPMENT OF CORPORATE GOVERNANCE IMPLEMENTATION

As a commitment to implementing good corporate management, WIKA applies GCG principles in its daily business activities in a consistent, sistematic and sustainable manner. The spirit embodied in the implementation of GCG at WIKA is the goodwill and determination of WIKA personnel to make WIKA a continually growing and developing company with good quality products and work processes as well as having Code of Ethics, including environmental responsibility, so that WIKA can contribute optimally to the acceleration of Indonesia’s economic development as proclaimed by the Government of the Republic of Indonesia.

WIKA’s commitment to the implementation of GCG principles can be seen from the effectiveness of its Governance Structure and Governance Process that has been implemented. The Governance Structure and Governance Process have encouraged the achievement of Governance Outcome in accordance with the expectations of the Company’s stakeholders.

The Company believes that the implementation of Good Corporate Governance (GCG) is the basis for the creation of a system of corporate governance that will become the Company’s strength in running a sustainable business, having superior competitiveness, and being able to provide added value for all stakeholders.

WIKA assures that GCG principles have been and will be applied to every aspect of its business and at all levels. In line with the continuous innovations produced, the Company continues to complement the structure and soft structure of GCG and build a reliable business management mechanism.

The consistent and comprehensive implementation of GCG in 2021 has resulted in external recognition through the awards received by WIKA, including.

RISK MANAGEMENT SYSTEM IMPLEMENTATION

To measure, monitor, and manage the main risks faced when conducting operational activities, the Company has a comprehensive risk management, guided by the Regulation of Minister of State-Owned Enterprises No. Per-01/MBU/2011 concerning the Implementation of Good Corporate Governance (GCG).

In implementing the Risk Management program, a Risk Management Department was formed, which currently has transformed into to the Risk Management & PMO Division, directly under the Board of Directors.

To ensure an effective Risk Management that supports organizational performance, the Company has implemented a risk management by referring to the risk management system policy from the Board of Directors that applies in WIKA Group. In ensuring the implementation of targeted risk management, the Risk Management & PMO Department has compiled:

- Risk Management System Guidelines;

- Risk Management Procedures;

- Work Instructions related to the implementation of Risk Management.

On an ongoing basis, WIKA Management conducts evaluation aimed at determining the effectiveness of risk management activities. The evaluation is done by, among others:

- Reviewing the contents of Risk Management Policies, Guidelines, and Procedures;

- Dissemination of Risk Management Policies, Guidelines, and Procedures;

- Carrying out the Risk Maturity Level (RML) assessment every year to achieve WIKA Group’s risk maturity score target in accordance with the Risk Management Policy.

The results of annual evaluation show that risk management at WIKA in 2021 has been adequate, with a Risk Maturity Level (RML) score of 3.89, exceeds the target of 3.85 according to the 2021 Risk Management Policy signed by the President Director.

WIKA 2021 risk profile and mitigation are as follows:

WIKA 2021 Risk Profile and Risk Mitigation

| No | Risk | Cause | Mitigation |

|---|---|---|---|

| 1 | Decrease in WIKA maturity level score | Migration of ISO 31000:2009 system to ISO 31000:2018 which has new assessment parameters (integration and leadership) |

|

| 2 | Maturity is achieved, but the business targets are not | Management system and operating results are not in-line |

|

| 3 | Not getting new contract turnover | Failed to see alternative market potential | Looking for alternative market potentia |

| 4 | Project productivity is not yet 100% | Project conditions are affected by global business conditions |

|

| 5 | The occurrence of negative events before preventive action is taken | Invalid data and not updated with actual conditions |

|

| 6 | Cashflow deficit in relation to the availability of owner’s funds | Global business conditions have not recovered |

|

INTERNAL CONTROL SYSTEM

The Company’s Internal Control System is designed, among other things, to ensure that every activity carried out within the Company can guarantee the implementation of all business activities in accordance with applicable laws and regulations, provide correct, accurate, complete and timely financial and management information, and improve the efficiency, effectiveness and economy in the Company’s operational activities.

The Company has designed and implemented a number of policies and mechanisms related to the Internal Control Integrated Framework developed by the Committee of Sponsoring Organizations (COSO) and the objectives of internal control according to COSO include operations, reporting, and compliance. Based on COSO, the elements of internal control include the followings:

- Control Environment;

- Risk Assessment;

- Control Activities;

- Information and Communication;

- Monitoring Activities

Internal Control System Evaluation and AdEQUACY

The Internal Control System has an important role in evaluating the adequacy and effectiveness of the internal controls carried out by the Company’s management at every level of the organization. The Internal Audit Unit evaluates the adequacy and effectiveness of the Internal Control System as a whole and the supervision conducted to support the Board of Directors’ assertions about the effectiveness of the Company’s Internal Control System. The Internal Control System evaluation is submitted to the Management and will be followed up and monitored to ensure that the Internal Control System is adequate in supporting the achievement of the Company’s goals and objectives.

WHISTLEBLOWING SYSTEM

The Company has developed the Whistleblowing System (WBS) as a form of its commitment to the implementation of GCG practices, which serve as a means of systematic delivery of information from stakeholders related to the management of the company, so that the information can be managed and followed up by referring to the applicable laws and regulations.

The Company has developed the Whistleblowing System which functions as a means of preventing, disclosing violations or acts of fraud within the Company and has been set forth in the Procedure for Complaints for Violations of Code of Conduct or Whistle Blowing No. WIKA-LDS-PM-02.01 Rev 00 Amd 02 November 26, 2020.

Every personnel or stakeholder who reports a violation of the code of conduct or violation of compliance will receive protection, both in terms of identity confidentiality and from possible retaliation by the reported party.

In promoting the awareness of WBS policies and implementation at all levels within the organization, the Company continues to increase the understanding and concern of WIKA’s personnel to report violations through WBS to create a clean work environment. To that end, the Company consistently conducts Whistleblowing System socialization in various ways. One way is by the Company distributing the Code of Conduct and Code of Corporate Governance books by email to all employees of the Company. Since 2021, WBS implementation at WIKA has also been integrated with the Corruption Eradication Commission (KPK) through a collaboration that was signed on March 2, 2021.

Until the end of 2021, the GCG Compliance Team did not receive any reports related to violation committed by WIKA’s corporate organs or personnel.

HUMAN CAPITAL MANAGEMENT AND INFORMATION TECHNOLOGY SYSTEM DEVELOPMENT

COVID-19 pandemic is still a challenge for WIKA in carrying out its business. To that end, the Company continues to improve the quality of Human Capital management to provide better support for the Company’s business development, in line with WIKA’s vision and mission. WIKA believes that one of the factors that can support the Company to realize its objectives is having reliable, loyal and competent Human Capital (HC). For that, WIKA continously conducts defined and sustainable HC management to create high-quality talents that are adaptive in facing the dynamics competition in the industry.

Human Capital Management at WIKA is carried out by WIKA Human Capital Division that has a role of being in charge of the entire HC management and development process, from the planning process to evaluating any ongoing work programs. Human Capital Division integrates HC management system with strategies to increase the competitiveness and accelerate the performance of the Company.

WIKA is fully aware that one aspect that becomes a supporting factor in improving employee performance is maintaining employee loyalty and a comprehensive/holistic appreciation. For this reason, WIKA focuses not only on remuneration and benefits, but also on health measures so that employees have a healthy mindset in terms of a healthy diet, mindset and lifestyle. This is done to keep employees healthy and motivated.

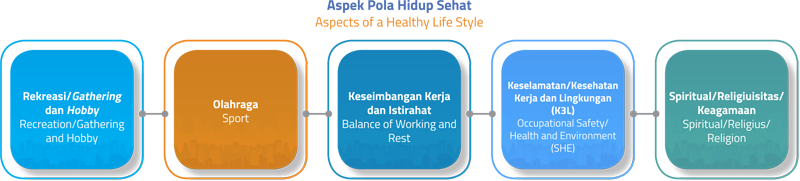

WIKA emphasizes the importance of appreciation for employee, which is not only limited to material appreciation. One form of rewards is through the Wellbeing Program, a balanced lifestyle, as illustrated in the following chart:

| Paradigm | Lifestyle | Dietary Habit |

|---|---|---|

| A process of mental/way of thinking that involves brain performance becoming the main reference point for the person. | A lifestyle applied by a person in life to seek a balance between work, fulfillment of physical and health needs in its implementation. | A dietary habit with healthy and balanced diet. Healthy food mean food from ingredients that are closer to results and processed in a modest/simple way. Balanced mean consisting of carbohydrates, protein, and fat. |

The Company shows its appreciation for each employee through wellbeing program that includes three dimensions of a healthy lifestyle such as physical, emotional and mindset dimensions.

With due regard to the Information Technology (IT) development, WIKA realizes that optimizing the use of information technology (IT) can lead the Company to achieve accelerated business growth, adapt to changes and challenges of business development, so that the Company will be more competitive and operational risks faced can be minimized.

The Company’s information technology is designed to improve work efficiency by automating various operational process, and improve competitiveness and competitive advantage by prioritizing sustainable innovation, and always take into account the Company’s businees needs in both operational and functional. The Company’s information technology system is equipped with superior human capital in charge of supervising and controlling the system.

WIKA has developed appropriate technology to accelerate business through strategic approaches and policies in IT sector based on Regulation of the Minister of SOE No. PER-02/ MBU/02/2018 concerning Information Technology Governance Principles of the Ministry of State-Owned Enterprises and the Company’s Internal Regulations related to organizational structure and Good Corporate Governance.

In order to ensure the implementation of good practices of IT Governance/Management as mandated by the Regulation of Minister of SOE, the Company is responsible for ensuring the successful implementation of IT programs by forming an IT Steering Committee and assigning person in charge from each function who has knowledge and competency in their respective fields, so that the process of IT creation and development as well as its implementation can be carried out according with the plan.

IT steering committee provides support for planning and implementation in short term and long term and functions as a supervisor for program implementation. The Company establishes rules and policies to support the acceleration of initiatives that refers to international IT operational standards.

Since 2018, the Company continues to carry out job description reconfiguration in order to transform object-based IT management approach to a function-based one. To strengthen and ensure business processes and good governance, the Company initiated to obtain ISO 20000 ITSM certification, ISO 27001 Security and Cobit 2019 with a score of 3.35 from the Ministry of SOE’s target of 3.00.

CORPORATE SOCIAL RESPONSIBILITY

Corporate Social Responsibility (CSR) is one of the main GCG implementations in the Company. The Company is fully aware that the fulfillment of the rights of stakeholders including customers, communities, employees and the state is a key factor in achieving sustainable performance.

CSR is important to support the growth and development of the Company. The Company locates CSR as part of long-term program. In the pursuit of achieving sustainable business, the Company strives to generate optimal performance for shareholders but also considers the ways to to make a maximum contribution in social and environmental aspects.

In addition, WIKA also has a commitment to carry out business and operational activities by paying attention to the quality, responsibility, and sustainability. In practice, WIKA designs CSR programs using the approach contained in ISO 26000, in which there are 7 (seven) core subjects used to ensure the sustainability of Company’s activities. The core subjects in ISO 26000 include:

- Good organizational governance;

- Enforcement of human rights;

- Humane and fair employment practices

- Management of Company’s activities on the environment;

- Reasonable operating procedures;

- Responsibility to consumers

- Involvement in community development.

The Company endeavors to make the principles contained in ISO 26000 such as accountability, transparency, ethical behavior, respect the interests of stakeholders, comply with applicable laws, respect the international norms, and respect the human rights, as the basis for implementing CSR in the Company.

The Company believes that business will be sustainable if a balanced attention is given to the aspects of return (profit), humanity (people) and environment (planet). Therefore, the Company makes CSR an inseparable part of the Company’s operations to support business sustainability.

PERFORMANCE ASSESSMENT OF COMMITTEES UNDER BOARD OF DIRECTORS

Until the end of 2021, WIKA does not have a Committee under the Board of Directors. Thus, no information is available regarding the performance appraisal of committees under the Board of Directors.

CHANGES IN BOARD OF DIRECTORS COMPOSITION

Throughout 2021, there were changes in the composition of Board of Directors, intended to fulfill the needs of the Company. The changes to the composition and appointment basis of the Board of Directors in 2021 are as follows:

| Name | Position | Term of Office | Office Period | Appointment Basis |

|---|---|---|---|---|

| Agung Budi Waskito | President Director | June 8, 2020 – 2025 AGMS | 1st | AGMS resolution dated June 8, 2020 |

| Hananto Aji | Director of Operation I | June 8, 2020 – 2025 AGMS | 1st | AGMS resolution dated June 8, 2020 |

| Harum Akhmad Zuhdi | Director of Operation II | June 8, 2020 – 2025 AGMS | 1st | AGMS resolution dated June 8, 2020 |

| Rudy Hartono | Director of Operation III | September 2, 2021 – 2025 AGMS | 1st | EGMS resolution dated September 2, 2021 |

| Ade Wahyu | Director of Finance and Risk Management | March 25, 2019 – 2024 AGMS | 1st | EGMS resolution dated March 25, 2019, then based on AGMS dated May 27, 2021 there was a change in the nomenclature of office and transfer of assignment from previously Director of Finance to Director of Finance and Risk Management. |

| Mursyid | Director of Human Capital and Development | June 8, 2020 – 2025 AGMS | 1st | AGMS resolution dated June 8, 2020 |

| Ayu Widya Kiswari | Director of QHSE | September 2, 2021 – 2026 AGMS | 1st | EGMS resolution dated September 2, 2021 |

Until the end of 2021, WIKA is led by the Board of Directors consisting of 7 (seven) persons, namely 1 (one) person as President Director and 6 (six) persons as Directors. The Company’s Board of Directors composition has also reflected the diversity of various aspects and backgrounds for effective, precise and prompt decision making, as well as ability to act independently

CLOSING REMARKS AND APPRECIATION

2021 is a year full of challenges that were not only felt by Indonesia but by the whole world, especially WIKA. Therefore, on behalf of the Board of Directors, we would like to give our highest appreciation to all employees who have been working with full dedication, so that WIKA managed to pass through the year of 2021 favorably.

We would also like to express our respect and gratitude to the Board of Commissioners and Shareholders for the supervision and directions, as well as constant guidance upon the measures we took in carrying out our mandate to manage and generate the best values. The same gratitude also goes to all business partners, regulators and stakeholders, hence WIKA can stand strong and continue to develop as a company with achievements and integrity.

We are optimistic that WIKA will be able to continue to advance into the future in the pursuit of achieving the goals set out in the Company’s vision and mission.

Jakarta, March 16, 2022

On behalf of the Board of Directors of PT Wijaya Karya (Persero) Tbk

Agung Budi Waskito

President Director